Introduction

In the world of finance, the bear market is a term that holds significant importance. It refers to a market condition characterized by falling stock prices, pessimistic sentiment, and investor fear. Understanding the concept of a bear market is crucial for investors and its impact extends beyond individual portfolios, affecting the overall economy.

Definition and Importance of Bear Markets

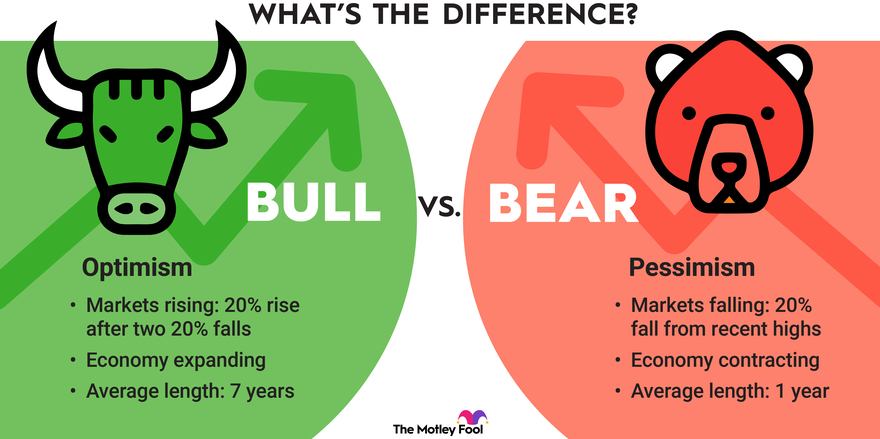

A bear market is a period of declining stock prices, typically accompanied by a downward trend in the overall market. It is often marked by a decrease of 20% or more from recent highs. Bear markets are important because they can have a significant impact on investors, consumer spending, and the broader economy. During a bear market, investors tend to become more cautious, leading to reduced investment and spending. This decline in economic activity can contribute to a slowdown in overall economic growth.

Characteristics of Bear Markets

The primary characteristics of bear markets include falling stock prices, pessimistic sentiment, and investor fear. As stock prices decline, investors may become increasingly cautious and opt to sell their holdings, exacerbating the downward trend. Pessimistic sentiment and fear can lead to a cycle of selling, further driving down prices.

This negative sentiment can be fueled by various factors, including economic indicators, geopolitical events, and market speculation. Bear markets can be triggered by factors such as economic recessions, political instability, or significant market disruptions.

Historical Cases of Bear Market

Several notable bear market events have had a profound impact on the economy throughout history. Three such examples are the Great Depression, the dot-com bubble, and the global financial crisis.

- The Great Depression (1929-1939):This was one of the most severe and prolonged bear markets in history. It was triggered by the stock market crash of 1929 and was characterized by a significant decline in economic activity, high unemployment rates, and widespread poverty. The Great Depression had a long-lasting impact on the global economy, leading to regulatory reforms and changes in economic policy.

- The Dot-com Bubble (1997-2001):The dot-com bubble was a period of excessive speculation in internet-based companies. Stock prices soared to unsustainable levels before collapsing in 2000. The bursting of the bubble led to a prolonged bear market and a significant decline in the value of technology stocks. This event highlighted the importance of valuations and sound investment strategies.

- The Global Financial Crisis (2007-2009):The global financial crisis was triggered by the collapse of the subprime mortgage market in the United States. It resulted in a severe credit crunch, a significant decline in stock markets worldwide, and a global recession. The crisis had a profound impact on the global economy, leading to increased regulation and a reevaluation of risk management practices.

These historical examples demonstrate the severity of bear markets and their long-term impact on the economy.

Coping Strategies for Bear Markets

Investors can employ several strategies to cope with bear markets and minimize potential losses. Here are some key strategies:

Diversification: Diversifying investments across different asset classes can help reduce risk. By spreading investments across stocks, bonds, real estate, and other asset classes, investors can mitigate the impact of a bear market on their overall portfolio.

Risk Management: Implementing risk management techniques, such as setting stop-loss orders or using hedging strategies, can help protect against significant losses during a bear market. These strategies involve setting predetermined thresholds for selling assets or using financial instruments to offset potential losses.

Defensive Investments: During bear markets, defensive investments such as bonds, gold, or cash equivalents tend to perform relatively better than stocks. Allocating a portion of the portfolio to defensive investments can provide stability and help offset losses in the equity market.

It is important to maintain a long-term perspective, avoid panic selling, and seek professional advice when navigating bear markets.

Opportunities in Bear Markets

While bear markets can be challenging, they also present opportunities for investors. Two notable opportunities are value investing and finding undervalued assets.

Value Investing: Value investing involves identifying stocks or assets that are trading below their intrinsic value. During bear markets, many quality companies may experience significant price declines due to market-wide pessimism. Value investors seek to capitalize on these opportunities by purchasing these assets at a discounted price with the expectation of long-term appreciation.

Undervalued Assets: Bear markets can create opportunities to acquire assets at attractive prices. Real estate, stocks, and other investments that are undervalued during a bear market may prove to be profitable in the long run. Successful investors have historically capitalized on these opportunities by purchasing assets when prices are depressed and selling when market conditions improve.

Conclusion

Understanding the bear market phenomenon is crucial for investors and the overall economy. Bear markets are characterized by falling stock prices, pessimistic sentiment, and investor fear. They can have a significant impact on investors, consumer spending, and economic growth. Historical cases, such as the Great Depression, the dot-com bubble, and the global financial crisis, highlight the severity and long-term effects of bear markets.

To cope with bear markets, investors can employ strategies like diversification, risk management, and defensive investments. Additionally, bear markets present opportunities for value investing and acquiring undervalued assets.

By understanding the characteristics of bear markets and implementing appropriate strategies, investors can navigate these challenging market conditions and potentially find profitable opportunities.